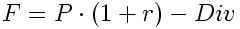

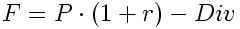

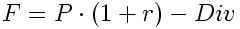

where F is the single-stock futures contract price, P is the underlying stock price, r is the annualized interest rate, and Div is the expected dividend.

where F is the single-stock futures contract price, P is the underlying stock price, r is the annualized interest rate, and Div is the expected dividend.

Single Stock Futures Overview

Single Stock Futures (SSF) are futures contracts on individual stocks, narrow based indexes or Exchange Traded Funds (ETFs). They are also referred to as Security Futures Products in some early literature. In late 2000, the U.S. Congress passed legislation lifting the ban on these products, which were already trading in Europe and elsewhere. Trading in SSFs on OneChicago began in November 2002. OneChicago lists futures on more than 500 well-known stocks such as IBM, Apple, Google and others. SSFs also trade on several foreign exchanges and are an important tool for professional traders. Security futures enable money managers, proprietary trading operations and hedge funds to efficiently execute a variety of trading strategies for U.S. listed equities including securities lending.

When a SSF is traded, both the buyer and seller put up a good faith deposit called margin. Margin requirements are generally 20% of the cash value of contract, although this requirement may be lower if the investor also holds certain offsetting positions in cash equities, stock options or other SSF in the same securities account. A OneChicago SSF is an agreement for delivery of 100 shares of the underlying security or ETF at a designated date in the future, called the expiration date.

Narrow based index futures (NBIs) are SSF on narrow based equity indexes (generally 9 or less stocks) and are cash settled. OneChicago lists a variety of “boutique” NBIs based on demand from large institutional customers called OneChicago Select Indexes. Select Indexes do not have an LMM assigned to them to make two-sided markets. At certain periods there may not be a bid and/or ask.

SSF on ETFs have similar characteristics to SSF, although the underlying security is shares in the ETF rather than common stock in a specific company. Thus at expiration, the deliverable assets are shares in the underlying ETF. OneChicago trades ETF such as the SRDR Trust (SPY), PowerShares QQQ, and the DIAMONDS ETF.

Calculation of SSFs

where F is the single-stock futures contract price, P is the underlying stock price, r is the annualized interest rate, and Div is the expected dividend.

where F is the single-stock futures contract price, P is the underlying stock price, r is the annualized interest rate, and Div is the expected dividend.

Another valuation of single stock futures can be found through the following:

where S is the price of the underlying (the stock price), PV(Div) is the Present value of any dividends entitled to the holder of the underlying between T and t, r is the risk free rate, and e is the base of the natural log. F is of course the price of the single stock futures contract.

where S is the price of the underlying (the stock price), PV(Div) is the Present value of any dividends entitled to the holder of the underlying between T and t, r is the risk free rate, and e is the base of the natural log. F is of course the price of the single stock futures contract.

Benefits of Single Stock Futures

Range of Trading Strategies

Single stock futures are used with a broad range of trading strategies and can be applied to a variety of portfolio management needs. Since the price of an equity future typically tracks the price of the underlying instrument nearly tick for tick, trading strategies used in the stock market today should be transferable to the stock futures market.

Electronic Trading

Security futures trading at OneChicago is fully electronic. Trade processing and clearing are fully automated using state of the art technology.

OneChicago's Single Stock Futures Tutorial

SSFs are considered a cost efficient method to invest in stocks. This is because SSFs have the cost of carry interest rate built into their price. This interest rate is locked when the trade is made and is determined in the SSF pricing by multiple participants in a competitive open market. By contrast, when purchasing stock on margin the variable interest rate is dictated by that single broker in a non-competitive environment which is subject to market interest rate volatility.

Launch Tutorial

Launch Tutorial

OneChicago's Calculator

The OneChicago calculator allows the investor to make a comparative analysis between the advantages of using Single Stock Futures versus the underlying equity. When using the calculator you can set your own criteria of your investment. The calculator allows the user to:

1. to establish the size of the transaction

2. the length of the holding period

3. the portion of the position that will be financed

4. the interest rate for either the debit balance (borrowing funds) or the credit balance (lending funds out).

The template for the calculator allows you to expand the details of your results by placing your mouse pointer over each area of the return so as to explain how the numbers were derived.

Launch Calculator

Launch Calculator