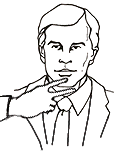

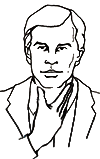

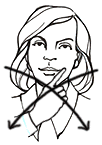

SELL

Hand signals – the sign language of futures trading – represent a unique system of communication that effectively conveys the basic information needed to conduct business on the trading floor. The signals let traders and other floor employees know how much is being bid and asked, how many contracts are at stake, what the expiration months are, the types of orders and the status of the orders. The signals are the favored form of floor communication, especially in the financial futures pits, for three main reasons:

Speed and efficiency

Hand signals enable fast communication over what can be long distances (as much as 30 or 40 yards) between the pits and order desks and within the pits themselves.

Practicality

Hand signals are more practical than voice communication because of the number of persons on the floor and the general noise level.

Confidentiality

Hand signals make it easier for customers to remain anonymous, because large orders do not sit on a desk, subject to accidental disclosure.

HAND SIGNAL DEVELOPMENT

Hand signals began being used extensively at CME® in the early 1970s, after the Exchange created the International Monetary Market (IMM) and became the first U.S. futures exchange to offer financial (rather than commodity-based) futures. Although speed had long been a key element in futures trading, it became even more important when financial futures entered the trading scene. Why? Because traders discovered they could take advantage of arbitrage opportunities between CME and other markets if they could trade quickly enough. (Arbitrage refers to the simultaneous purchase and sale of the same or an equivalent commodity or security to profit from price discrepancies. When price discrepancies emerge in the marketplace, the arbitrageur buys/sells until it is no longer profitable, or until prices are back in equilibrium.) Hand signals met the need to speed up communication in the fast-moving financial futures pits.

Following are the signals most commonly used at CME. Some are unique to particular pits on the CME floors. But take note, some signals may mean one thing in a certain pit, while a similar signal may mean something entirely different in another pit.

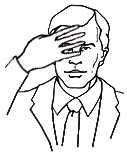

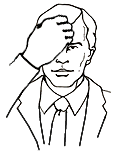

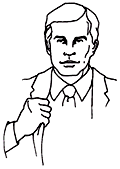

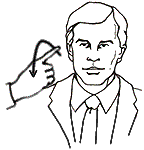

BUY/SELL

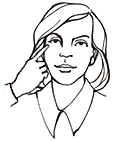

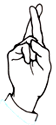

When indicating you want to buy (signaling a bid), the palm of the hand always faces toward you. You can remember this by thinking that when you’re buying, you’re bringing something in toward you. When making an offer to sell (offering), the palm always faces away from you. Think of selling as pushing something away from you.

| BUY |  |

SELL |

|

Your palms face you when you are signaling a "buy," and face away from you when you are signaling a "sell."

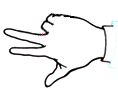

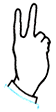

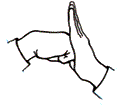

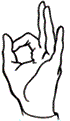

PRICE

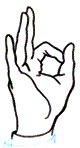

To signal price, extend the hand in front of and away from the body. For the numbers one to five, hold your fingers straight up. For six through nine, hold them sideways. A clenched fist indicates a zero or "even."

ONE |

|

TWO |

|

|

|

|

|

THREE |

|

FOUR |

|

|

|

|

|

FIVE |

|

SIX |

|

|

|

|

|

SEVEN |

|

EIGHT |

|

|

|

|

|

NINE |

|

EVEN |

|

Note: Price signals indicate only the last digit of a bid or offer. For example, a "0" signal may refer to a "40" bid.

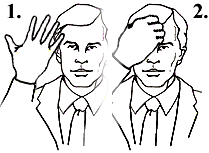

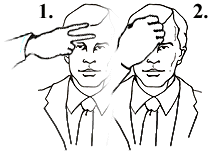

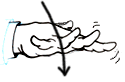

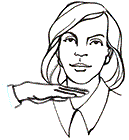

QUANTITY

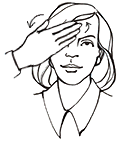

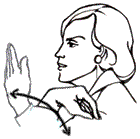

To indicate quantity – the number of contracts being bid or offered – touch your face.

To signal quantities one through nine, touch your chin.

To show quantities in multiples of 10, touch your forehead.

To show quantities in multiples of 100, make a fist and touch your forehead.

ONE |

|

TEN |

|

|

|

|

|

SEVEN |

|

NINETY |

|

|

|

|

|

ONE HUNDRED |

|

||

FIVE HUNDRED |

|

||

SEVEN HUNDRED |

|

||

EXPIRATION MONTHS

All futures contracts have an expiration month; thus, there are standard hand signals that indicate each month.

JANUARY |

|

FEBRUARY |

|

MARCH |

|

APRIL |

|

MAY |

|

JUNE |

|

JULY |

|

AUGUST |

|

SEPTEMBER |

|

OCTOBER |

|

NOVEMBER |

|

DECEMBER |

|

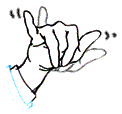

EXPIRATION CYCLES

Trading Eurodollars involves a set of hand signals that convey expiration cycles. Eurodollars are listed in quarterly cycles, extending out 10 years. They are traded in 12-month "packs," consisting of four 3-month quarters, with expiration months of March, June, September and December. Each 12-month pack is assigned a certain color. For example, the first series of contracts – those that are up to one year out – are called the "whites," although they’re usually just referred to as the "front months." After "the whites" come the "reds," (the series of contracts one to two years out), followed by the "greens" (which are two to three years out), and so on. (The colors for the years four through 10 are, respectively, blue, gold, purple, orange, pink, silver and copper.) There is a hand signal that indicates each of these packs, except for the whites or front months. Below are some packs signals.

REDS |

|

|

GREENS |

|

|

BLUES |

|

|

GOLDS |

|

FILLED |

|

WORKING |

|

STOP |

|

At that point, a stop order becomes a market order and the broker must attempt to get the best price when filling it. Can be used to enter or exit both long and short positions. For example, if you are long and fear a drastic price drop, you can issue a stop order to be activated when the contract drops to a given price. Your stop then becomes a market order that the broker will attempt to fill before the price drops even more — even if it requires selling at or below the stop price. Likewise, a short can issue a "buy" stop order if he fears the price will rise. |

|

OUT/CANCEL |

|

OPTIONS |

||||

PUT |

|

CALL |

|

|

SUMMARY

This has been a brief introduction to CME’s hand signals. Anyone who works on the Exchange floors needs to know and use these signals perfectly. Hand signals are essential for successful pit trading at CME, and using the wrong signal could result in a substantial loss.

"An Introduction to Hand Signals" is published by Chicago Mercantile Exchange for general educational purposes only. Although every attempt has been made to ensure the accuracy of the information contained herein, CME assumes no responsibility for any errors or omissions. All matters pertaining to rules and specifications herein are made subject to and are superseded by official CME rules.

This material is published by CME Education for the purpose of educating exchange members, floor clerks, employees and students. Reproduction for any purpose without the written permission of CME Education is strictly prohibited.